A case study to know the truth

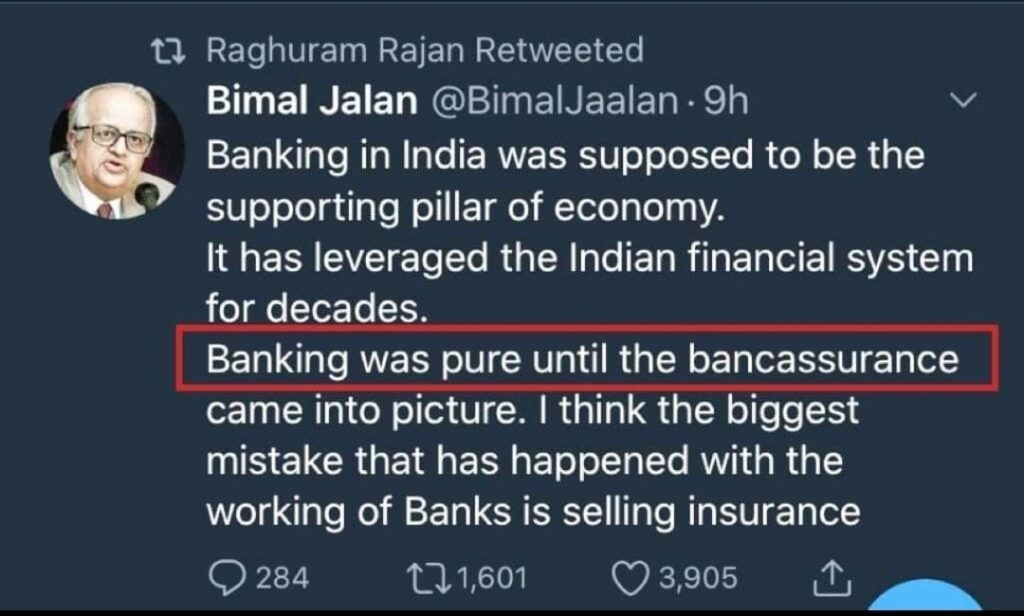

Former Governor of Reserve Bank of India, Shri Bimal Jalan has said in one of his tweets,” Banking in India is supposed to be the supporting pillar of economy. It has leveraged the Indian financial system for decades. Banking was pure until the bancassurance came into picture. I think the biggest mistake that has happened with the working of Banks is selling insurance.”

This tweet was retweeted 1601 times including by the Former governor of Reserve Bank of India, Shri Raghuram Rajan and was liked by 3905 twitter users.

Now a question arises what is wrong with Banks selling Insurance? Why two former governors of Reserve Bank of India subscribe to the view that the biggest mistake that has happened with the working of Banks is selling insurance? There must be something seriously wrong with the concept of bancaassurance. What is bancaassurance?

Bancaassurance – KEY TAKEAWAYS

• Bancassurance is a partnership between a bank and an insurance company, whereby the insurance company is allowed to sell its products to the bank’s clients.

• The insurance company benefits from increased sales from a broader client base and the ability to sell without paying broker commissions and expanding its sales force.

• The bank benefits from improved customer satisfaction and additional revenues from sales of insurance products.

The above takeaway points paint a win win situation for all the three stakeholders i.e. Banks, Insurance companies and the customers. To go to the depth of the issue our financial desks decided to probe deeper into the subject. Our team decided to select a rural bank having bancassurance tie-up with an insurance company. We selected a Rural Bank because clientele of these banks live in rural India and is not much educated and therefore totally depend upon the staff for any type of financial dealings including insurance. Therefore dealings with such type of customers should be more transparent, safe ,productive and customer centric. Safety and growth of their investment is of prime importance.

On the above criteria our team decided to select Aryavart Bank with its headquarters at Lucknow and Bajaj Allianz Life Insurance Co. Ltd. Both entered into bancassurance tie-up sometime in 2010.

They launched a micro insurance product with the name ,” Aryavart Serve Shakti Suraksha” popularly known as Triple S scheme.

Benefits of this scheme at a glance ( As printed on the back of welcome letter cum receipt issued at the time of enrollement)

1.Non Medical cover up to age 65

2.Simple documentation: One simple form to be submitted

3.Attractive maturity benefits at the end of term*

4.Double accident benefit and last two clauses dealt with Tax benefits available.

The maximum amount which could be invested by a single person was Rs. 10 thousand. No KYC was required as it was available only to account holders of the bank. Term of this scheme was 5 years. We could not get any authenticated data but Bajaj Allianz life Insurance Co. Ltd. is liable to answer following question to clear clouds of doubts hovering over modus operandi adopted for procuring business-

- What were the year wise Incurred Claim Ratios and Claim Settlement Ratios under this scheme during the 5 year period during 2010 to 2015?

- Was this scheme given to account holders of the bank only or to non customers also?

- Did Insurance Company opened any account with the Bank for collecting premium? If not then what was the mode of premium collection? What was the time gap between deducting the premium from a beneficiary account and deposit in company’s account? Beneficiary was covered from which date? From the date of deduction of premium of from the date of credit in company’s account? What if someone met with accident during this period?

- What was the mode of delivering policy bond to the customers by the company? What is the proof that all policy bonds were delivered to respective beneficiaries by the company?

- What was the ratio of premium received by debiting a deposit account and a loan account?

- Number of policies lapsed year wise? What was the ratio of these lapsed policies as per the nature of payment of first premium i.e. whether first premium was paid by debiting deposit account or loan account? How much amount out of this lapsed amount was paid to the beneficiaries?

- How much was the maturity amount of policies in general? Whether it was less or more than the premium paid amount?

- Whether all maturity amounts were paid on time or some amount could not be credited due to wrong/Incomplete account information? Number of such beneficiaries and amount involved? What steps were taken by the insurance company to trace the beneficiaries and pay the maturity amount? Did the insurance company paid any interest on the late payment of maturity amount?

- Was there any protest from the beneficiaries when they got the maturity amount lesser than the premium paid amount?

- Was any extra amount was paid to beneficiaries beyond the maturity amount so that it matches the premium paid amount , through an outside agency?

- What was the mode of such payments? Whether IRDAI approves such payment?

- How many Bank employees and top functionaries of Bank were taken to foreign Trips on pretext of conferences by the insurance company?

- How many trips were arranged within India outside Bank’s service area in the name of conferences by the insurance company?

If we could get answers to all these questions we will come to know how this insurance company has committed white collar loot, robbing the hard earned money of farmers, rural artisans and persons doing small and petty businesses.

Bank Employees were lured to generate business for the insurance company and were suitably rewarded for this generosity by taking the good performers to foreign as well as trips within India and spending luxuriously on their travel and stay arrangements. Therefore it will not be unreasonable to conclude that Insurance Company adopted all sort of malpractices to generate business.

Mr. Bimal Jalan has rightly pointed out that purity of banking system was compromised after Banks started selling insurance products.

We wish that this write up will waken up the authorities i.e. IRDAI, Department of Financial Services from their slumber and they will not hesitate in ordering a high level probe into the affairs of this insurance company especially tie-up of this company with the Aryavart Bank .

We tried to know the views of insurance company. A whatsapp message was send to Zonal Manager of insurance company on 2nd October to know who is competent authority to present company’s views on the issues raised in this write up so that an unbiased story may be presented before the readers. But unfortunately no response was received from their side. Therefore we are presenting our side of story only .

Time has come when the IRDAI should stop acting like an actuary. It should start behaving like an Regulator and should use its whip on errant insurance companies so that faith of public is once again restored in IRDAI and other regulatory authorities.